Posted on: Monday, September 9, 2024

With a more positive outlook for autumn, confidence should continue to return to the housing market, as inflation remains under control and interest rates are now taking their first steps downwards.

The property market has remained active, if a little subdued, over the summer. However, the first bank rate cut in four years, along with subsequent accelerated mortgage rate drops, has resulted in a boost to buyer activity, providing a more solid foundation for the potential for stronger sales as we enter the colder months. The number of potential buyers contacting estate agents about homes for sale has increased from 11% year-on-year in July to 19% since the start of August (Rightmove). Increased political certainty and an improved economic outlook has also contributed to improving housing market sentiment.

The housing market has proved resilient and fared better than many expected at the start of the year. Despite the added dynamic of the General Election, consumer confidence remains buoyant. Mortgage approvals for house purchases in the UK reached 62,000 in July, their highest level in almost two years. This represents a 2.3% increase from the previous month and a 26% rise compared to a year ago (Bank of England). With improving sentiment, the latest consensus forecast predicts 2.2% house price change through 2024, up from a 2024 forecast of -2.2% at this time last year (HM Treasury Average of Independent Forecasts).

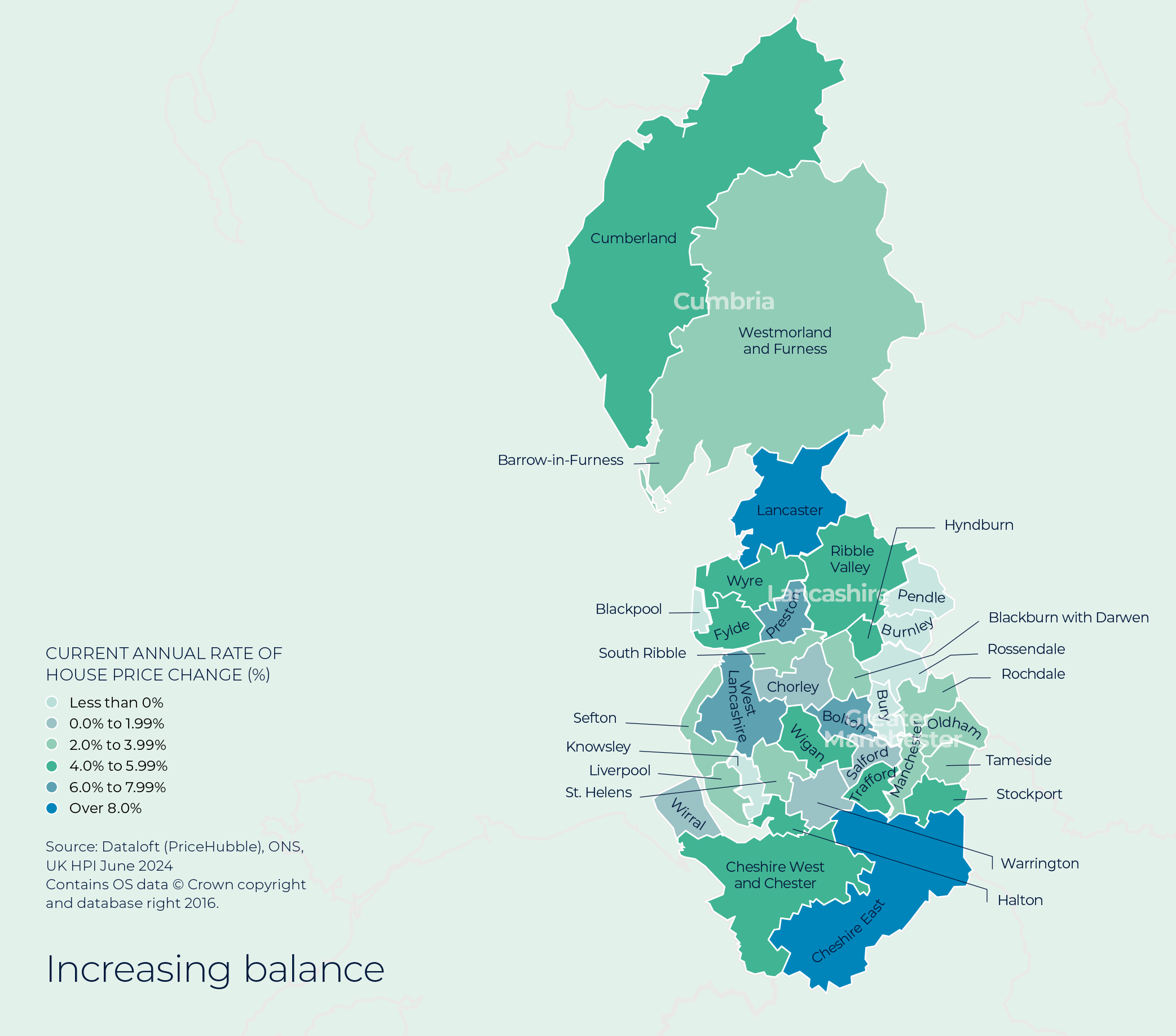

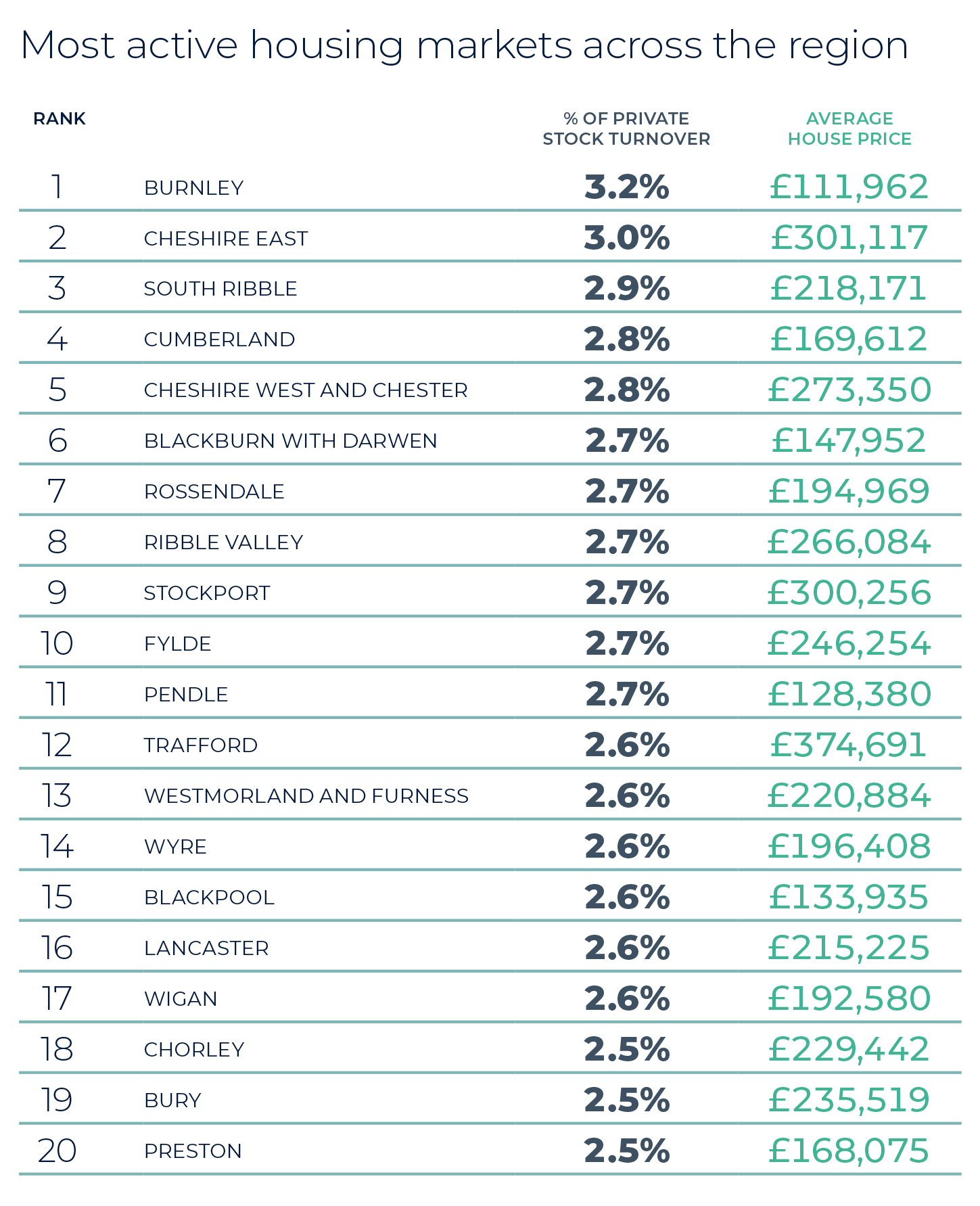

The average estate agent has 33 homes for sale, 16% higher than a year ago (Zoopla). Improved supply and more buyers in the market has resulted in a more balanced housing market, with higher sales volumes but more stable price inflation. Two thirds of agents report that there are three or more prospective buyers for each of their properties currently available, compared to 55% when the same question was asked the previous quarter (Dataloft by PriceHubble (poll of subscribers)). At 3.7%, annual property price growth in the North West has improved from -0.5% at the start of the year (UK HPI). Looking ahead, continued modest house price growth is expected for the remainder of the year, with stronger increases possible outside of expensive regions like the South East due to lower affordability pressures.

Three years after the final lockdown restrictions were lifted, house hunters are once again prioritizing location over space, a shift from the previously well-documented 'race for space'. Transport links were rated as the sixth most important factor when choosing a property, rising 8 places from 2021 and ranked important by 74% of buyers. Buyers now value transport links more than square footage, which has dropped to seventh place, down from second in 2021 (Market Financial Solutions).

Sell your property with your local expert this autumn. Contact your local Guild Member today.